The international banking system is quite mysterious. With over 30,000 banks around the globe, they manage enormous amounts of assets. Just the top 10 banks hold about 25 trillion US dollars. Banking today can seem incredibly complex, but it all started with a simple idea to make life easier.

Back in the 11th century, Italy was the hub of European trade. Merchants from across the continent gathered to trade goods, but they faced a significant issue: too many currencies. In places like Pisa, merchants had to deal with seven different types of coins. The constant need to exchange money led to outdoor transactions on benches, hence the word “bank” from the Italian “banco,” meaning bench.

Travel dangers, counterfeit money, and difficulty in getting loans sparked a new business model. Home brokers started giving credit to businessmen, while merchants in Geneva developed cashless payments. Banks soon spread across Europe, even lending to the church and European kings.

Today, banks are essentially in the risk management business. People deposit money in banks and earn a small interest. The bank then lends this money at higher interest rates. It’s all about calculated risks since some borrowers might default. This system is vital for our economy; it funds home purchases and business expansions. Banks take unused funds from savers and turn them into useful resources for society.

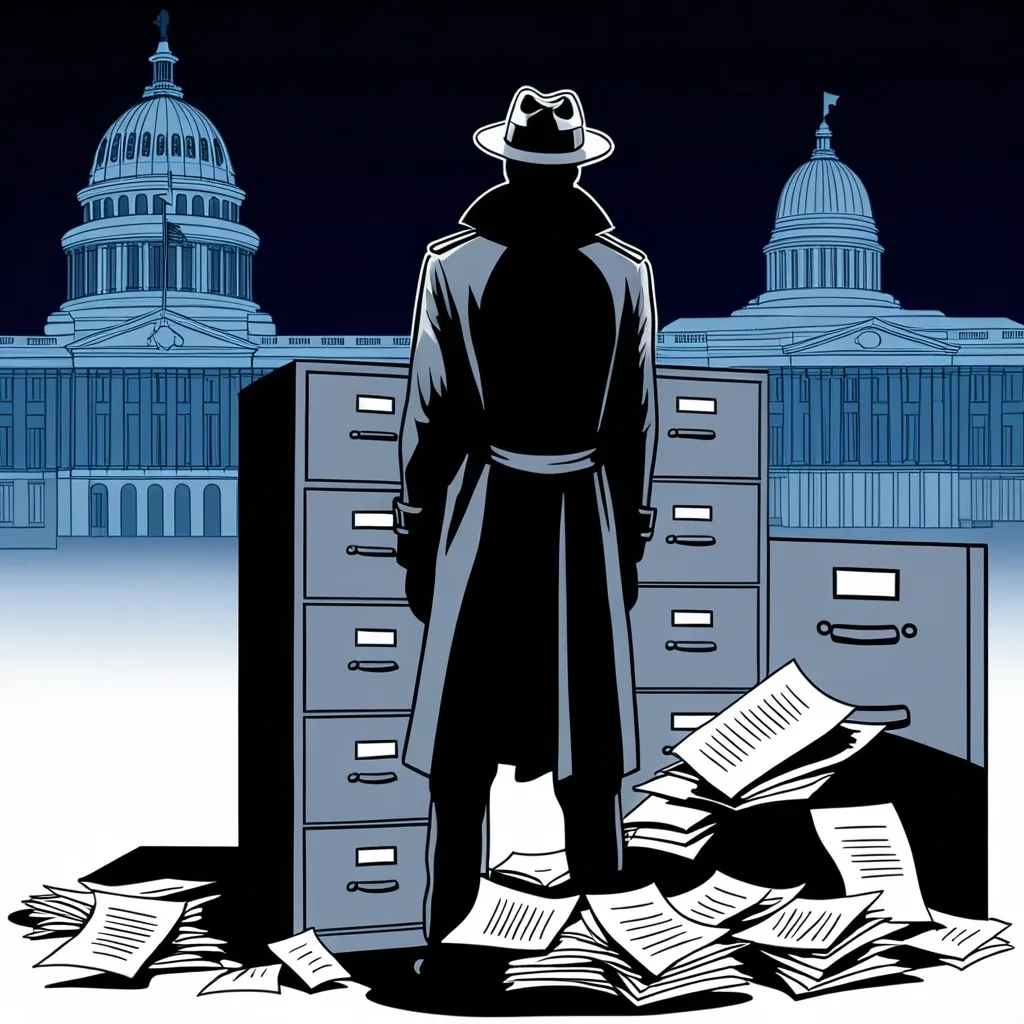

Banks also earn from savings deposits, credit card businesses, currency trading, and cash management services. The problem today is that many banks have shifted from offering long-term financial products to seeking short-term, high-risk gains. During financial booms, major banks engaged in risky financial constructs, aiming for quick profits and hefty bonuses. This was akin to gambling and had severe consequences for economies and societies.

Remember 2008? Banks like Lehman Brothers gave credit to almost anyone wanting to buy a house, creating a dangerous risk. This led to the collapse of the housing market in the US and parts of Europe, triggering a global banking crisis. Stocks plummeted, economies were shattered, and millions lost jobs and money. Major banks had to pay billions in fines, and their trustworthiness plummeted. Governments had to bail out these banks to prevent bankruptcies. New regulations and emergency funds were enforced to avoid future crises, although some tough laws were blocked by the banking lobby.

Today, new financing models are emerging. Investment banks now charge yearly fees instead of commissions, motivating them to act in their clients’ best interests. Credit unions, established in the 19th century to bypass credit sharks, offer similar services to banks but focus on shared value over profit. They help members create opportunities, reinvesting back into communities. Credit unions are democratic, with members electing their board of directors. They vary globally, from small groups to large organizations with billions in assets. Credit unions managed to survive the last financial crisis better than traditional banks due to their member-focused approach.

Crowdfunding has skyrocketed, enabling people to get loans from many small investors, bypassing banks. It has launched many new tech companies on platforms like Kickstarter and Indiegogo. Investors feel part of bigger projects, with risks spread widely, minimizing individual losses if a project fails.

Lastly, microcredits have transformed lives, especially in developing countries. These small loans allow people who previously couldn’t get funds to start businesses, helping them escape poverty. Microcredits have grown into a multi-billion-dollar industry.

In essence, banking might not thrill everyone, but its role in providing funds to people and businesses is crucial. The future of who will do it and how remains in our hands.